Insider Trading in India: Regulatory Evolution and Landmark Cases

InsiderQ • Regulatory Evolution • 5 min read

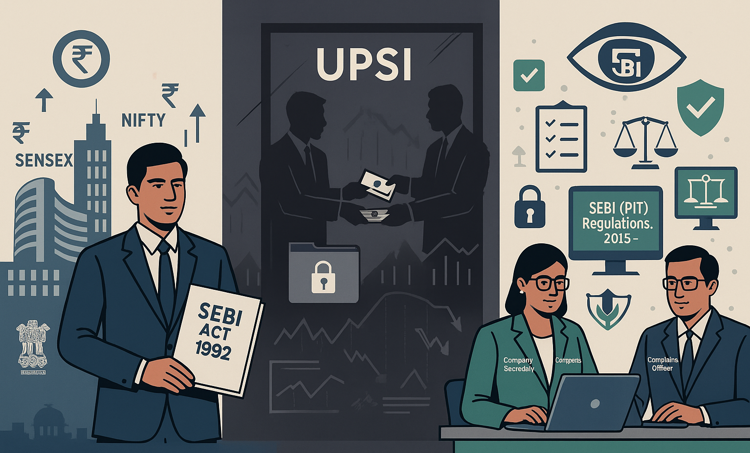

Insider trading represents one of the most serious threats to market integrity and investor confidence in modern financial markets. In India, the Securities and Exchange Board of India (SEBI) has continuously strengthened its regulatory framework to combat these malpractices, evolving from basic prohibitions to comprehensive compliance mechanisms. The recent IndusInd Bank case, alongside historical precedents, underscores the critical importance of robust internal controls and ethical corporate governance in maintaining market credibility.

Legal Framework: The Regulatory Foundation

SEBI Act, 1992: The Cornerstone

The Securities and Exchange Board of India Act, 1992, established SEBI as the primary market regulator with broad powers to protect investor interests and maintain market integrity. Section 11 of the SEBI Act empowers the board to prohibit fraudulent and unfair trade practices, forming the foundation for insider trading regulations.

SEBI (Prohibition of Insider Trading) Regulations, 2015: The Modern Framework

The SEBI (Prohibition of Insider Trading) Regulations, 2015, as amended in March 2025, form the cornerstone of India's legal framework against insider trading. Key provisions include:

Definition and Scope (Regulation 2):

- Insider: Any person who is or was connected with the company or deemed to have been so connected, and who is reasonably expected to possess unpublished price-sensitive information (UPSI)

- Connected Person: Directors, officers, employees, and their immediate relatives who have access to UPSI

Core Prohibitions (Regulation 4):

- Trading in securities while in possession of UPSI is strictly prohibited

- Communication, procurement, or counseling on dealing in securities based on UPSI is forbidden

- Both direct and indirect trading through connected persons is covered

Compliance Architecture (Regulations 8-9):

- Listed companies must implement comprehensive codes of conduct

- Designation of compliance officers with specific responsibilities

- Mandatory disclosure requirements for trading by designated persons

- Pre-clearance mechanisms for trades by insiders

Penalty Framework (Regulation 11):

- Monetary penalties up to ₹25 crore or three times the profit made/loss avoided

- Market access restrictions and disgorgement of unlawful gains

- Criminal proceedings under Section 24 of the SEBI Act

Learning from Landmark Cases

The Rajat Gupta Affair (2011-2012)

One of the most high-profile insider trading cases involving an Indian executive occurred in the United States. Gupta was convicted in June 2012 of four criminal felony counts of conspiracy and securities fraud in the Galleon scandal. He was sentenced in October 2012 to two years in prison, an additional year on supervised release and ordered to pay $5 million in fines. This case highlighted how insider trading networks can span across continents and involved information sharing between board members and hedge fund managers.

Recent Enforcement Actions

The case originated after SEBI identified suspicious trading patterns around the financial results announcements of Infosys for four quarters, covering from December 2019 to September 2020. SEBI's action in the Infosys case demonstrates the regulator's sophisticated surveillance capabilities in detecting unusual trading patterns around corporate announcements.

The IndusInd Bank Case: A Contemporary Analysis

Case Overview

In May 2025, SEBI issued an ex-parte interim order against five senior executives of IndusInd Bank, including former CEO Sumant Kathpalia and former Deputy CEO Arun Khurana, for alleged insider trading. These individuals reportedly sold shares while possessing UPSI related to significant accounting discrepancies in the bank's derivative portfolio.

Key Allegations and Findings

- Information Asymmetry: Executives possessed material non-public information about accounting irregularities

- Timing Analysis: Share sales occurred strategically before public disclosure of the issues

- Financial Impact: Avoided losses totaling approximately ₹19.78 crore

- Regulatory Response: Immediate market access restrictions and asset freezing

Enforcement Measures

SEBI's swift action included:

- Ex-parte interim orders barring access to securities markets

- Freezing of trading accounts to the extent of avoided losses

- Initiation of detailed investigation proceedings

- Public disclosure to maintain market transparency

The future belongs to organizations that view compliance not as a burden but as a strategic differentiator in an increasingly transparent and interconnected global marketplace. As SEBI continues to strengthen its enforcement capabilities and expand its surveillance reach, the cost of non-compliance will only continue to rise, making proactive compliance the only viable long-term strategy.